8 Best CRMs for Accountants and Accounting Firms 2025

Keeping track of financial information is super important for accountants. They work with lots of numbers, records, and data that help make big money decisions. In the past, accountants used paper files and tricky Excel sheets to manage their clients’ financial info. But things are changing, and now accountants really need a tool called a CRM for accountants to do their job better.

A CRM acts like a digital hub for accountants. It allows businesses to store, organize, and access all their customer data in one place. Moving from paper or complicated Excel sheets to a customized CRM solution. This comprehensive guide will help accounting professionals understand the value of CRM systems, compare different options, and make an informed decision on the best CRM solution for their specific needs.

What is a CRM for accountants?

Meaning: A CRM (Customer Relationship Management) for accountants is a tool that helps manage client information and improve day-to-day work. It keeps all client details, like contact info and past communications, in one place, making it easy to stay organized. It also helps track deadlines, store documents safely, and even connect with accounting software to simplify tasks like invoicing. By using a CRM, accountants can work more efficiently, stay on top of important dates, and provide better service to their clients.

CRM system adoption has proven to be an essential tool for certified public accountants (CPAs) and accountants. These platforms have transformed the way businesses manage massive amounts of client information, making their day-to-day operations more efficient and effective.

A CRM for accountants allows professionals to provide better service, establish strong client connections, and eventually grow their accounting practices by providing a streamlined and organized approach to client management.

Learn more about it: Best CRM for Service Industry

Why Do Accountants Need a CRM?

In today’s fast-paced and client-focused world, accountants must juggle multiple tasks, from managing client data to ensuring timely follow-ups and compliance. A Customer Relationship Management (CRM) system acts as a game-changer by streamlining client interactions, organizing workflows, and enhancing productivity. For accountants, a CRM is not just a tool—it’s a strategic asset that helps build stronger client relationships, ensure accuracy, and drive business growth.

- Centralized Client Management: A CRM keeps all client information—contact details, communication history, and preferences—in one place, making it easy to stay organized.

- Better Communication and Follow-Ups: With reminders and task tracking, a CRM ensures deadlines like tax filings and consultations are never missed.

- Workflow Efficiency: By integrating with accounting tools, a CRM simplifies processes like invoicing and payment tracking, saving time and reducing errors.

- Secure Documentation: Store and access client documents safely, ensuring compliance with regulations and quick retrieval when needed.

- Growth and Scalability: As your accounting practice grows, a CRM helps manage more clients efficiently without losing the personal touch.

Software used by Accounting firm VS A feature-rich CRM Solution

| Traditional Tools Used by Accounting Firms | Integrated Functions in a CRM Solution |

| Digital Calendar for Scheduling Meetings and Tasks | – Centralized scheduling and task management within the CRM platform |

| Time Tracker for Billable Hours | – Automated time tracking and billing functionalities directly integrated with CRM |

| File Sharing Tools | – Seamless document management and secure file sharing within the CRM environment |

| Invoicing Software | – Invoicing capabilities, generating and managing invoices, integrated into the CRM |

| Project Management Tools | – Project tracking and management features, all within the unified CRM environment |

| Spreadsheets for Forecasting and Financial Analysis | – Robust reporting and analytics tools for financial forecasting within the CRM |

Accountants CRM Must-Have Features

Contact Management: This is the foundation of any CRM, allowing you to create detailed client profiles, store important information (tax ID, contact preferences, engagement history), and categorize clients for better organization.

Activity Management: Track all interactions with clients, including emails, calls, meetings, notes, and even file uploads. This provides a centralized record of communication and facilitates collaboration within your team.

Task Automation: Automate repetitive tasks that eat away at valuable time. This could include sending appointment reminders, follow-up emails, invoice notifications, or even triggering workflows based on specific document uploads.

Secure Document Management: Store, organize, and securely share essential client documents within the CRM. This eliminates the need for separate file storage systems and ensures everyone on the team has access to the latest versions.

Email Marketing: Craft personalized email campaigns to communicate with clients about deadlines, tax updates, firm news, or share documents directly within the email. Track email engagement and optimize your outreach for better results.

Reporting and Analytics: Generate reports to gain valuable insights into client engagement, project performance, and overall firm activity. Use this data to identify areas for improvement, track key performance indicators (KPIs), and make data-driven decisions.

Project Management: For firms managing complex client projects, having project management features within the CRM can be beneficial for tracking deadlines, assigning tasks, and monitoring progress.

Top 8 CRM options for accounting firms

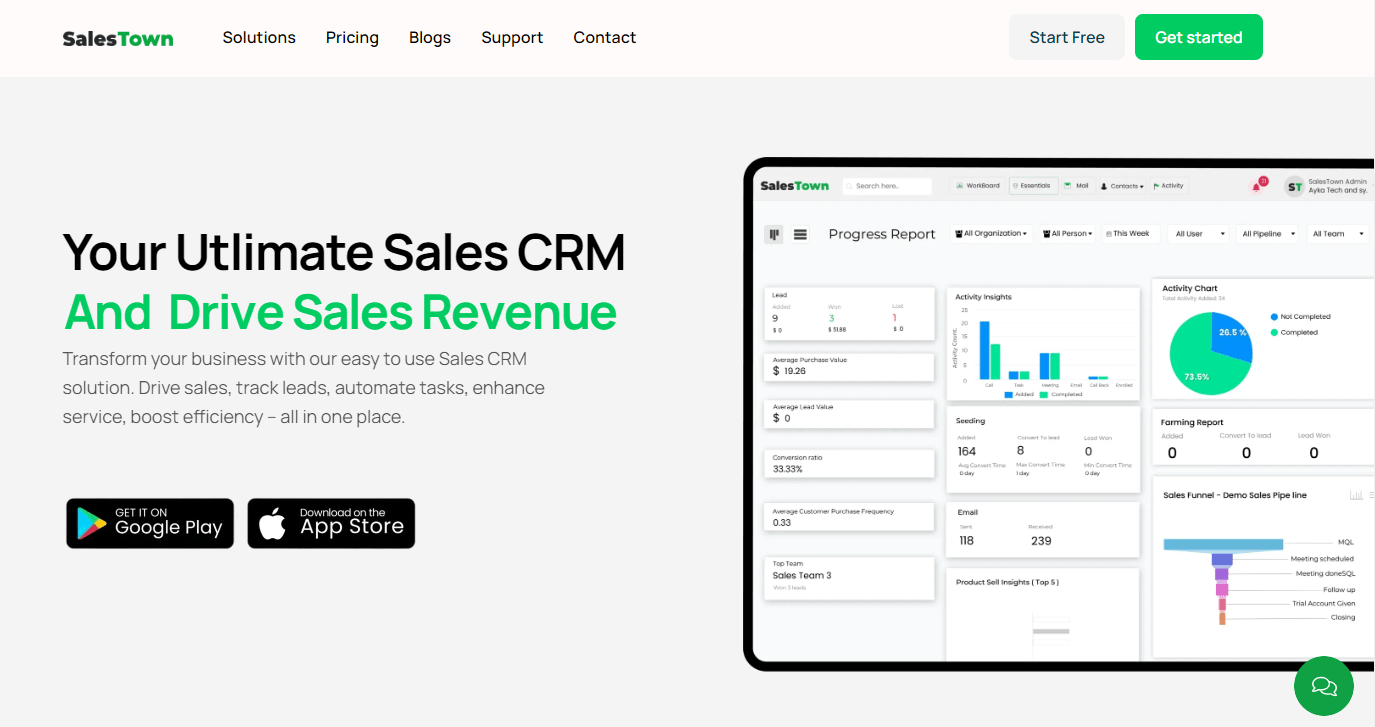

1. SalesTown CRM: Best Accounting CRM for Client and Workflow Management

SalesTown CRM offers a compelling option for accounting firms seeking a user-friendly and affordable solution to manage client communication and workflows. Here’s a breakdown of its key features and how it caters specifically to accounting professionals:

Features:

- Contact Management: Create detailed client profiles with customizable fields to capture essential information like tax IDs, contact preferences, and engagement history.

- Activity Management: Track all client interactions, including emails, calls, meetings, and notes, in a centralized location for streamlined communication and improved team collaboration.

- Pipeline Management: Visualize your client onboarding and service processes with a customizable pipeline. Track the progress of each client engagement, ensuring timely completion of tasks and deliverables.

- Task Automation: Automate repetitive tasks like sending appointment reminders, follow-up emails, or invoice notifications. This frees up valuable time for accountants to focus on strategic initiatives.

- Email Marketing: Craft personalized email campaigns to communicate with clients about upcoming deadlines, tax updates, or firm news. Track email engagement and optimize your outreach for better results.

- Document Management: Securely store, organize, and share client documents within the CRM. This eliminates the need for separate file storage systems and ensures everyone on the team has access to the latest versions.

pros:

- User-friendly interface

- Integrated email and WhatsApp marketing capabilities

- Quick setup and implementation

Cons:

- Limited customization in the free version

- Advanced features require paid upgrades

Best for: Small and medium size Accounting firms seeking a customizable and easy-to-use CRM with robust client management and automation features.

Sign up for a free Demo today

2. TaxDome: Comprehensive CRM for Accountants and Tax Professionals

TaxDome is a specialized CRM designed specifically for the needs of accounting firms. It prioritizes security and boasts a comprehensive feature set for managing client interactions, documents, and workflows.

Features:

- Secure client portal for document exchange and collaboration.

- Automated workflows for common accounting tasks.

- E-signature capabilities for streamlining approvals.

- Built-in tax organizer for efficient client onboarding.

- In-depth reporting and analytics for client performance insights.

Pros: Tailored features for accountants, robust security, automated workflows.

Cons: May be pricier than some general-purpose CRMs.

Best For: Accounting firms seeking a secure, all-in-one CRM solution designed for their specific needs.

3. Method CRM: Best Customizable CRM for Accountants

Method CRM focuses on project management and offers powerful integrations with popular accounting software like QuickBooks and Xero. It’s ideal for firms managing complex client projects.

Features:

- Project management tools for tracking client work and deadlines.

- Seamless integrations with accounting software for streamlined data flow.

- Automated time tracking and invoicing capabilities.

- Client communication tools like email and secure portals.

- Business intelligence tools for generating reports and analyzing trends.

Pros: Excellent project management, deep accounting integrations, automation tools.

Cons: Learning curve for complex features, may not be ideal for smaller firms.

Best For: Accounting firms managing complex client projects and seeking tight integration with their existing accounting software.

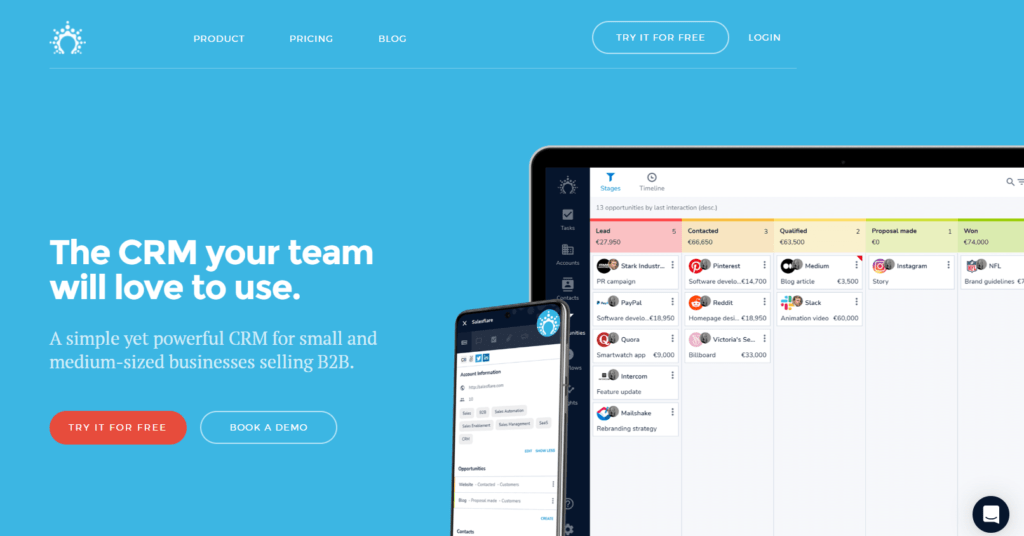

4. Salesflare: Best CRM for Small Accounting Firms

Salesflare is an intelligent CRM that automatically enriches contact data and automates tasks. It’s a good option for firms looking to save time on data entry and focus on building relationships.

Features:

- Automatic data enrichment from emails, social media, and web searches.

- Automated task creation and reminders for follow-ups.

- Visual pipeline management for tracking client progress.

- Powerful email tracking and analytics.

- Built-in reporting for key performance indicators (KPIs).

Pros: Automatic data enrichment, task automation, visual pipeline management.

Cons: Limited customization options, may not be ideal for complex client management.

Best For: Accounting firms seeking a user-friendly CRM with time-saving automation features for data entry and task management.

5. Zoho CRM: Best Customizable CRM for Accounting Firms

Zoho CRM is a popular and affordable CRM solution offering a good balance of features and scalability. It provides integrations with Zoho Books accounting software and other popular apps.

Features:

- Contact management with detailed client profiles and interaction history.

- Sales pipeline management for tracking leads and opportunities.

- Workflow automation for repetitive tasks.

- Reporting and analytics for client insights and performance tracking.

- Integrations with Zoho Books and other Zoho applications.

Pros: Affordable, scalable, good feature set, integrates with Zoho Books.

Cons: Reporting and automation features may not be as advanced as some competitors.

Best For: Accounting firms seeking a cost-effective and scalable CRM solution with integrations for their existing accounting software.

6. HubSpot CRM: Best Free CRM for Accounting Firms

HubSpot CRM offers a free plan with basic features for managing contacts, deals, and communication. It’s a good starting point for smaller accounting firms or those new to CRMs.

Features:

- Free forever plan with basic contact management and deal tracking.

- Free email marketing tools for client communication.

- Paid plans offer additional features like automation, reporting, and integrations.

- Integrates with other HubSpot marketing and sales tools.

Pros: Free plan, user-friendly interface, integrates with other HubSpot tools.

Cons: Limited features in the free plan, may not be suitable for complex client management.

Best For: Smaller accounting firms or those new to CRMs seeking a free solution for basic client management and communication.

7. Accelo: Best CRM for Project-Based Accounting Firms

Accelo is a CRM designed specifically for project-based businesses, making it an excellent choice for accounting firms that manage multiple client projects. It helps firms track and manage client relationships, projects, and communications in one place.

Features:

- Tracks projects, tasks, and client communications in a centralized system.

- Offers time tracking and invoicing capabilities.

- Automated workflow and task management features.

- Integrates with popular accounting and email tools.

Pros: Excellent for managing client projects, automates workflows, and tracks time and billing in one platform.

Cons: May be more complex than simpler CRMs, and pricing can be high for smaller firms.

Best For: Accounting firms that handle project-based work and need a comprehensive CRM to manage client relationships, projects, and billing efficiently.

8. Liscio: Best CRM for Client Communication in Accounting Firms

Liscio is a CRM specifically designed to enhance communication between accounting firms and their clients. It simplifies the process of sharing documents, managing tasks, and communicating securely, making it an excellent choice for firms prioritizing client collaboration.

Features:

- Secure document sharing and e-signature capabilities.

- Centralized messaging platform for easy communication.

- Client task management and workflow tracking.

- Mobile app for on-the-go access to client communications.

Pros: Focused on secure communication, easy-to-use interface, great for document sharing and e-signatures.

Cons: Limited advanced features compared to more comprehensive CRMs, may not be ideal for firms needing deep project management tools.

Best For: Accounting firms that prioritize secure and efficient communication with clients and need a simple, streamlined CRM for document management and task tracking.

Here are some tips for choosing an accounting CRM:

- Consider your needs and goals. What features do you require for managing clients, invoicing, billing, etc.? Make a list of must-haves.

- Look for CRMs designed specifically for accounting professionals. They will have accounting-specific tools like invoicing, time tracking, tax planning, etc. Popular options include FreshBooks, Zoho Books, Xero.

- Make sure the CRM integrates with your existing accounting software. You want contact and financial data to flow seamlessly between programs.

- Look for flexible invoice templating and customization options. You want to brand invoices and set them up to match your workflow.

- Check for strong reporting and analytics. You want to easily see key metrics across your practice.

- Ensure the CRM has robust security and compliance with accounting regulations. Your data should be encrypted and protected.

- Consider mobile optimization. You want to access client data and send invoices on the go via smartphone apps.

- Compare costs. Check for free trials and subscriptions plans based on number of users and features needed.

Why SalesTown CRM Is the Best CRM for Accountants

SalesTown CRM was designed precisely to fulfill the needs of accounting professionals. It goes above and beyond a basic CRM by incorporating accounting-specific capabilities like automatic time tracking, billing and invoicing, trust accounting, and tax-season workflow automation. SalesTown connects with major accounting tools such as QuickBooks Online and Xero, allowing customer data to flow across systems smoothly. The dashboard provides an overview of staff productivity, billable hours, client profitability, and other metrics. Robust reporting and analytics help in the discovery of new prospects and the identification of underperforming clients.

SalesTown also allows for unlimited user collaboration, allowing employees to safely share information and tasks for seamless teamwork. SalesTown CRM has been the top choice among accountants searching for an all-in-one solution to create outstanding client experiences and manage an efficient practice, due to a clean UI and outstanding client service.

Boost your bottom line with Salestown

Frequently Asked Questions ( Faqs )

Q. What is CRM for accounting, and why is it important?

CRM for accounting is a tool that helps businesses manage and strengthen their relationships with clients and customers in the financial context. It organizes and tracks interactions, transactions, and communication with clients, streamlining processes and enhancing customer satisfaction. This system is crucial for accounting firms as it fosters better client communication, improves service delivery, and ultimately contributes to business growth by retaining satisfied clients and attracting new ones.

Q. What features should I look for in a CRM system for accounting?

In a CRM system for accounting, prioritize features such as seamless integration with accounting software, automated invoicing and financial tracking, customizable reporting tools, secure data management, and a user-friendly interface. Additionally, ensure it supports client communication tracking, task management, and scalability to accommodate your business growth. These features will help streamline financial processes, enhance client relationships, and improve overall efficiency in your accounting operations.

Q. Can CRM help with lead generation for accounting services?

CRM systems can assist with lead management, helping you identify potential clients, track their progress, and convert them into paying customers.

Q. Can CRM improve client retention and satisfaction?

Yes, Customer Relationship Management (CRM) can significantly enhance client retention and satisfaction. By centralizing customer information, streamlining communication, and providing personalized experiences, CRM systems empower businesses to better understand and meet individual needs. This results in stronger relationships, improved service, and ultimately higher levels of customer loyalty and satisfaction.